Energy Risk Forecaster: UK businesses to suffer two-fold blow of rising energy prices

Forecasts for prolonged volatility and higher costs in the wholesale market, combined with the continued impact of rising non-commodity charges, will see British businesses experience a two-fold blow to their energy budgets unless urgently addressed with a revised strategy.

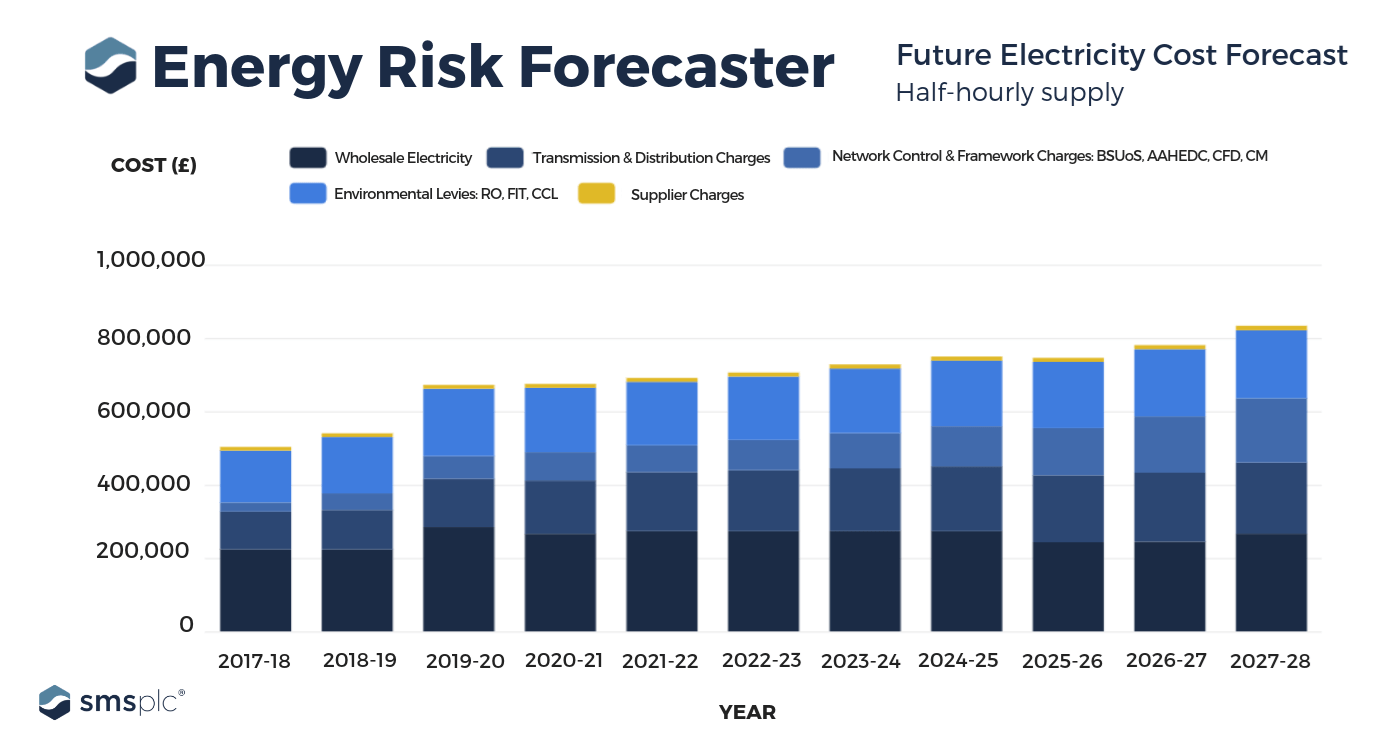

Business energy costs in the UK could increase by 55% by 2028 compared to 2017-18 prices, according to updated figures published by SMS Ltd’s Energy Risk Forecaster.

More alarmingly for businesses, however, is that most of this increase is expected to happen within the next two years, with energy prices estimated to rise 35% by 2020 compared to the past 12 months.

This updated forecast, based on the dual impact of significant rises in wholesale costs and the continued increases in non-commodity charges, emphasises a heightened sense of urgency for UK businesses to review their energy risk management strategies.

For instance, organisations are urged to reconsider their approach to energy purchasing, particularly given the current context of the wholesale market and imminent rises in the Capacity Market charge and Climate Change Levy as of 2019.

Businesses are also strongly recommended to consider investment in other areas that affect their energy spend, such as billing and energy efficiency, in order to mitigate the longer-term financial impacts of energy price rises.

Businesses can get a clearer visualisation of this impact today by using SMS Ltd’s updated and free-to-use Energy Risk Forecaster.

Above electricity cost forecast generated by an example profile of a large energy consumer (on half-hourly supply) using 10,000,000kWh per year.

What’s behind the two-fold blow of energy prices?

Wholesale energy costs

The wholesale market has experienced significant volatility since we first published the Energy Risk Forecaster in August 2018. Following the extended spell of cold weather in February – which coincided with Britain’s first winter without Rough storage – gas prices have peaked at near ten-year highs. This has been largely due to demand for gas injections needed to restore the storage levels previously rinsed by the ‘Beast from East’. At the same time, the oil market has made a dramatic recovery this year, fuelled mainly by geopolitical factors, causing a corresponding spike in power prices. Furthermore, with the government’s Budget 2018 maintaining the UK’s top-up carbon tax at £18 per tonne of CO2 until April 2021, the high carbon price is set to continue to contribute to higher power prices in the foreseeable future.

The above developments in the wholesale market are reflected in SMS Ltd’s updated forecast for the next ten years ahead, which also takes into account various other underlying fundamentals of supply and demand, the economics of generation and the expected impact of legislation between now and 2028.

Non-commodity costs

Besides adjusting our forecast for the wholesale market, we have also reviewed our outlook for non-commodity costs, which are expected to be the primary drivers for increased business energy costs in the next ten years. We have taken into account the increases in the Contract for Difference levy, Renewable Obligation and Feed in Tariff levies, all of which have risen above inflation rates during 2018, while also adjusting our figures for the Climate Change Levy (CCL) in light of the recent Budget 2018 announcements. While the CCL was already set to increase 45% for electricity and 67% for gas in 2019, the government’s decision to further increase taxation on gas in 2021/22 (rising to 60% of the value of electricity) is set to deepen the financial impact on large gas consumers in particular. A significant increase in the cost of the Capacity Market 2019/2020 and changes to the Distribution Network Use Of System Charges (DUoS) have also been considered in updates to the Energy Risk Forecaster.

About the Energy Risk Forecaster

The Energy Risk Forecaster provides a projection of your organisation’s annual energy costs until 2027-28. Simply choose the energy type (electricity or gas), enter your tariff and latest annual consumption rate, then let the Energy Risk Forecaster generate your results. Your estimated ten-year energy costs allow you to easily envisage the potential future financial impact on your business and can be used to inform an energy strategy that helps mitigate this risk.

The intention of the SMS Ltd Energy Risk Forecaster is not merely to point out the direct price impact on businesses (and how this can be influenced by a smarter energy-buying strategy), but also call attention to the ripple effect of these extra costs on energy billing and consumption. In order to minimise risk of higher costs in coming years, organisations will need to take greater care over how they are invoiced for their energy (through comprehensive bill validation), and perhaps most pertinently, find ways to reduce the amount of energy they use through the implementation of monitoring, efficiency and flexibility solutions.

At SMS Ltd, we are helping businesses look at the bigger picture of energy price rises, offering a holistic approach to energy risk management across procurement, billing, consumption and project delivery.

For a no-obligation discussion on the potential price impact for your business, and what steps you can take to mitigate this risk, get in touch. Call us on 02920 739535 or email us we’ll get back to you.